You’re scrolling through social media, and suddenly everyone’s arguing about a vote that could change the crypto game. That’s exactly what’s happening right now with Binance, the biggest cryptocurrency exchange on the planet. In a bold twist, Binance is asking everyday users—yes, people like you—to decide whether it should list Pi Coin, a buzzy but polarizing cryptocurrency. Here’s the scoop.

Pi Network: The Smartphone Crypto That’s Got Everyone Hyped

Pi Network isn’t like Bitcoin or Ethereum. Forget expensive mining rigs—you can “mine” Pi tokens right from your phone. This simple idea has pulled in over 100 million users worldwide, many of whom are dipping their toes into crypto for the first time. But there’s a catch: Pi has been stuck in a testing phase for years. Coins earned by users aren’t tradeable yet, and people can’t cash them out.

That might finally change soon. Pi’s team promised to launch its “Open Mainnet” (think of it as flipping the switch to make Pi Coin real money) by February 20. But rumors are swirling about another delay, pushing it to February 28. Still, excitement is off the charts. Why? Because if Binance lists Pi, it could turn those pretend coins in your app into actual cash.

Binance’s Power Move: “You Decide”

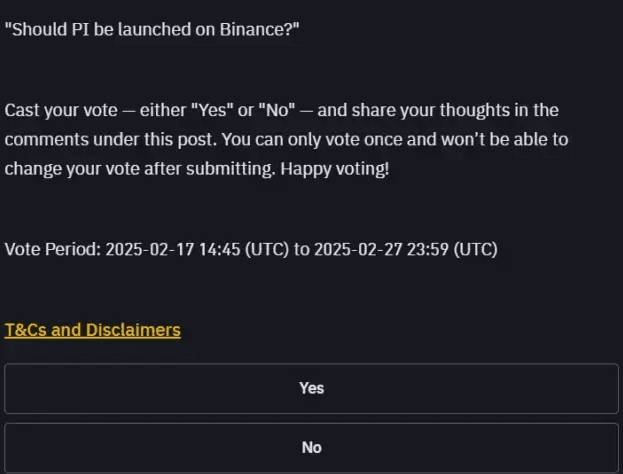

Binance doesn’t usually let users vote on which coins get listed. But starting February 17, anyone with at least $5 in their Binance account can cast a “Yes” or “No” vote—and the poll runs until February 28, the same day Pi’s big launch might happen.

Why the sudden democracy? Critics have roasted Binance in the past for listing risky tokens. By putting the choice in users’ hands, Binance is walking a tightrope: keeping things transparent while avoiding blame if things go sideways. “The final call still depends on our internal review,” the exchange warned, reminding everyone the poll is just a suggestion, not a rule.

Pi Coin’s Wild Ride: Hype vs. Reality

Pi Coin isn’t officially tradeable yet, but that hasn’t stopped speculators. On some platforms, people are already trading “IOUs” (think of these as pretend prices) for over $81 per Pi. The debate is split:

- True Believers: If Binance lists Pi, fans say the price could explode to 500–1,000, thanks to Binance’s army of users.

- Skeptics: Naysayers warn Pi could crash to $20 or less if big exchanges stay away. China’s government even called Pi a possible scam, and exchanges like Bybit have already refused to touch it.

Pi’s supporters fire back, pointing to its massive fanbase and strict ID checks for users. But let’s be real: social media hype can make anything look like the next big thing—until it isn’t.

What Happens Next?

- The Vote: A “Yes” vote doesn’t mean Pi gets listed, but it’s a loud signal. Binance will still worry about regulators, especially after China’s warnings.

- Pi’s Deadline: The team needs to stick the landing. Delays have annoyed users, and another slip-up could tank trust.

- Other Exchanges: Smaller platforms like OKX plan to list Pi starting February 20, but Binance’s call is the one that matters.

Why Should You Care?

If you’ve been mining Pi for years, this could finally be your payday—or a reality check. For everyone else? It’s a front-row seat to how wild crypto can be. Prices swing fast, and not every “hot” token survives.

As one crypto watcher joked, “Pi’s value won’t come from memes or votes. It needs real-world uses, like buying pizza or paying bills.” Whether Pi becomes the next big thing or fizzles out, this vote shows how crypto is changing: you don’t need a suit on Wall Street to shape the future of money.

Stay curious, stay skeptical, and never bet your lunch money on it.